A variety of financial ratios can help business owners make sense out of financial data, like profit, sales, and assets, that can be difficult to analyze without context. Ratios don’t give you answers to questions, like how well you are performing and what you need to do to improve. Instead, financial ratios help you see patterns and trends in your financial data. And that context helps you to better structure your thinking, which in turn helps you to better identify risks (so you can take steps to mitigate them) and opportunities (so you can take steps to leverage them).

One of the most important types of financial ratios for a business owner to consider is asset management. Asset management ratios help a business understand how well the company is managing its assets and operating expenses to drive sales.

Calculating asset management ratio trends from your own financial data can help you determine if you are progressing over time. Also, comparing these financial ratios to other companies in your industry (i.e., benchmarking) allows you to see if you are performing better or worse than your peers. Let’s look at these financial ratios and how to calculate them.

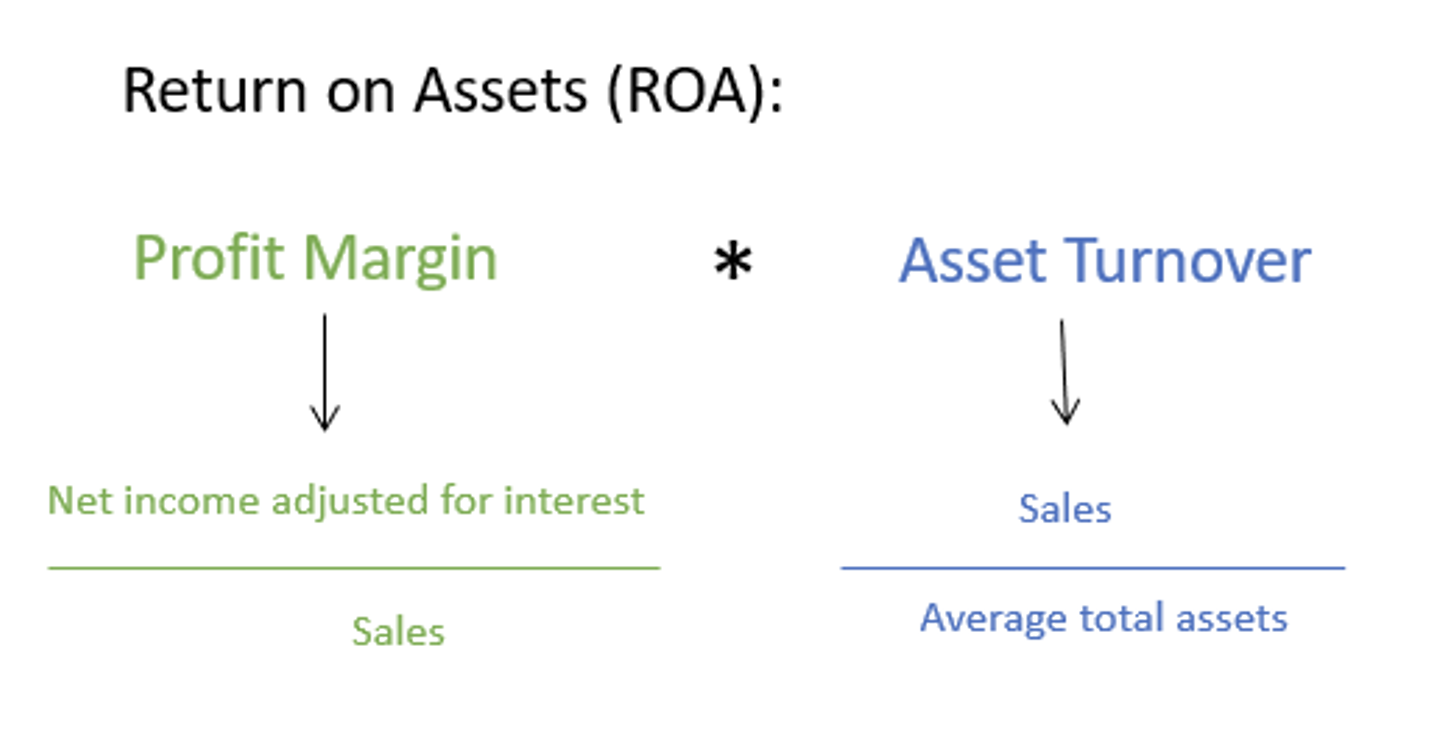

Return on Assets

Return on assets or ROA measures how well a company is performing on its operating and investing decisions. When using this calculation, it’s important that you take out any financing decision impact from the calculation so you can isolate those operating decisions affecting the business. Therefore, when calculating ROA, remove interest income, but keep in interest expense as well as the effects of any tax shield on taxes that are owed.

Profit Margin Ratio

Profit margin is a ratio that measures how much a business is making or keeping for every dollar of sales it makes. If a company sees its profit margin is declining over time, the business can decide to address this issue.

To improve profit margin, a company could take actions such as negotiating a less expensive price for a raw material it purchases to manufacture products or finding a new supplier that is cheaper. As an alternative, the company could choose to increase prices while keeping costs the same. Of course, that’s always a risk, as increasing prices could lower your sales, which would offset any benefit from the price increase.

So, it’s important to conduct a financial analysis on any actions you’re considering, to bring a larger understanding of what else your decision could impact. The goal is to make sure that all the assets you’re tying up are generating as much in sales as they can. Working with an experienced financial consultant—ideally, a trusted advisor you can develop a long-term, mutually beneficial relationship with—can help you understand the impact of any decisions you may be considering and help you determine the best way to improve the profit ratio measure.

Asset Turnover Ratio

Now, let’s look at asset turnover. Asset turnover is a ratio that measures turnovers of the major lines on your balance sheet. And if you can increase sales for a given level of assets in any line on the balance sheet without anything else happening, that’s going to boost your return on assets and improve your efficiency.

For a better total asset turnover ratio, your business could take actions such as changing the number of days you give customers to pay you, which is called the average collection period. Decreasing this time would allow you to have the same level of sales with less money tied up in receivables. Another way to improve your asset turnover ratio is to find efficiencies in your operations that allow you to manufacture your inventory and deliver sold products quicker. This improves your inventory turnover ratio by decreasing the number of days your inventory sits in your warehouse.

When measuring ROA, it’s important to note that when you try to improve one aspect of the different financial levers in the equation, you may affect other areas that make the overall ratio worse. For example, you may decide you want to be more efficient in your operations to improve your asset turnover ratio. So, you decide to invest in new machinery with the latest technology that allows you to manufacture your products much faster.

However, the cost of this new machinery could reduce your profit margin beyond any efficiency gains you added. This would result in decreasing your ROA, which is the exact opposite of what you intended to do. That’s why it is critical to work with a trusted financial advisor to help you determine the next best steps to take when using financial analysis ratios to understand your business better.

The key to understanding asset management ratios is to recognize that these calculations won’t give you the answers and tell you what to do. Instead, working with a financial advisor, you can use these ratios to begin to structure your thinking, break your business down into pieces, determine the probability of what can happen, and make the best combination of decisions that give you the best outcome. Using this structured thinking approach, you can use ratio analysis to break things down into smaller and smaller pieces, so you can make strategic decisions for your company. Book a discovery call today with a financial consultant from Simple Startup who is so ready to help.