Business Valuation

As a business owner, it’s important to understand the value of your business for a number of reasons. These reasons may include identifying ways to improve the value of your business, when you’re preparing to pitch to investors, addressing stakeholders like your board, if you are thinking about selling your business, and finally, you may simply want to know what your sweat equity has built. Regardless of the reason for wanting to know how much your business is worth, knowing can provide you with valuable insight.

Before diving into our methods of business valuation, it is important to underline that each method suits a certain scenario and that the value of your business can be further understood by giving the method additional context, which is where valuation ratios come into play. In this article, you can expect to learn our top methods for valuing a business as well as the valuation ratios you can use to give them additional context. This particular blog will focus on valuation theories that are often used for bigger or more established companies, in a follow up to this blog we will outline additional valuation methods related to startup and younger companies.

Methods of Business Valuation

Many have so eloquently referred to business valuation as part science and part art. This sentiment may be because as we mentioned earlier, business valuations can be used for a variety of reasons, and often the purpose behind the valuation guides the valuation itself. To see what we mean let’s review our first method, the asset-based approach.

Asset-Based Approach

The asset-based approach gets straight to the point of its namesake by calculating the value of a business by subtracting the liabilities from the assets of that business. This method may also be referred to as the book value approach or the asset accumulation approach.

This method of valuation is often used for a company that has limited or negative earnings, a company that has a significant number of assets, or even a company that is preparing for liquidation. However, this method is not a good representation of the market value of a business, therefore does not work well in merger and acquisition scenarios.

Market Approach

If you’ve ever purchased a home or a piece of real estate, then the market approach may be familiar to you. Essentially, in the market approach, your business is  compared to similar businesses in size and industry to determine its likely value.

compared to similar businesses in size and industry to determine its likely value.

And also just like in real estate, this method pulls data from databases that may include Pratt’s Stats, Bizcomps, BizBuySell, and the Institute of Business Appraisers for small to mid-sized businesses and PitchBook for publicly traded and larger companies. The data used to determine value is a multiple of gross sales or earnings to compare to your business. This method is a reliable method to determine business value when looking to sell your business or on the flip side if you’re looking to acquire a company.

Income Approach

In the income approach to valuing a business, the calculation assumes that the value of a business is based on expected future income and takes into account future risks to earnings. More simply stated your business is worth the present value of the income stream it would bring to an investor or purchaser.

This approach to valuing a business is a great indicator of value for businesses with positive earnings as it is based on the assumption it is likely that the business will be able to retain a similar level of earnings into the future. This approach is often used for a business preparing to sell or be acquired. Methods under this approach include the capitalization of excess income method and the discounted cash flow method.

Let’s take a deeper look into the discounted cash flow method. A method the Simple Startup team is very familiar with.

Discounted Cash Flow Method

The name of this approach to business valuation is another one that gives you a sneak peek of how it is calculated. In the discounted cash flow method the value of a business is estimated by projecting cash flow. The discounted cash flow approach is good for business owners preparing to sell their business, for investors calculating the value of a business for investment, and can even be used to determine if a piece of equipment or a big purchase is a good long-term investment.

The principle behind this approach is the fact that time is money and that money is worth more today than it will be in the future. To use this method, you will need to know the period of time for which you’re calculating, annual projected cash flow, a discount rate, and the terminal value representing the perpetual growth rate for years outside of the time period being calculated for.

Projected cash flow can then be discounted providing the present value estimate. The net present value estimate or NPV can then used to determine the potential for return for the business (or investment).

Which Method is Best?

Any method for valuation is only worthwhile if the right method is used for the purpose of the valuation and if more context is given to the calculation scenario. This is where valuation ratios can provide great insight.

Valuation Ratios

Accountants (investors, and financial analysts) LOVE ratios and we’ve talked about a number of them before on our blog. Do you remember the working capital ratio or the quick ratio from our discussion on liquidity? Well, a valuation ratio shows the relationship between the market value of a company (the price it can achieve in an open market) or its equity or a financial metric like cash flow or earnings.

This type of ratio can help an investor understand what they are paying for the revenue stream that they would gain as well as compare investment opportunities against similar companies currently trading on the market.

For example, if you use the EV-to-EBITDA formula (which we will talk more about below) and get a .5 multiple that doesn’t mean much in and of itself until you compare it with like company’s EV-to-EBITDA ratios. You can then see how a potential investment company’s multiple compares to similar companies and begin to question why that is and whether it is a good investment.

Let’s take a look at some typical valuation ratios to deepen your knowledge on the subject.

Price-to-Earnings Ratio

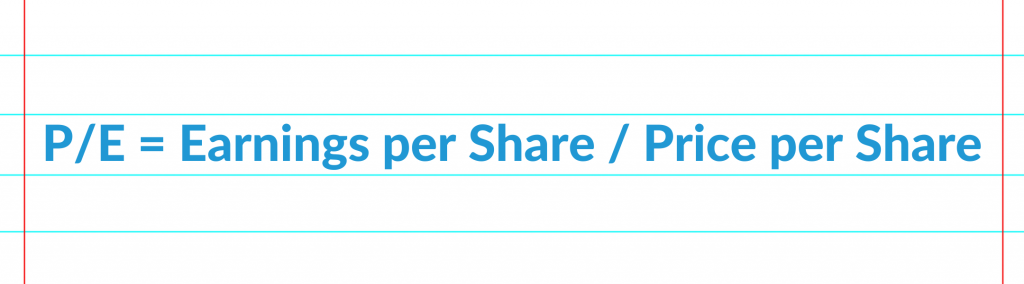

The price-to-earnings (P/E) ratio or the amount an investor would pay for a dollar of earnings determines the relationship between the price per share and net income (or earnings) of a company. This is a widely-used tool for investors to determine a company’s stock valuation and can show if it is overvalued or undervalued. This number is then often benchmarked against other companies in the same industry or against the S&P 500 Index.

The formula for this ratio is as follows:

When using this ratio, though it is widely used, it is important to keep in mind that it does not bring company debt into the equation and also that earnings are calculated at the discretion of the company. This can make this ratio more easily susceptible to manipulation whereas a ratio based on cash flow is not. This nicely leads us to our next ratio, price-to-cash flow.

Price-to-Cash Flow Ratio

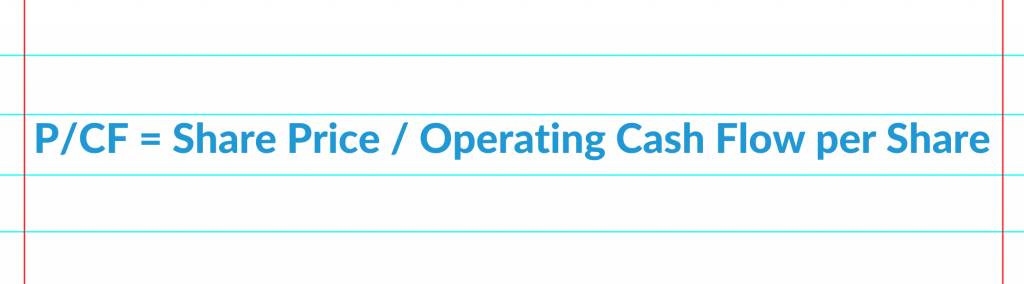

The price-to-cash flow (P/CF) ratio is a measure of how much cash a company generates in relation to its market value. As we mentioned above, cash flow is less at the discretion of a company’s accounting processes and more a rote determination of the company’s cash flow and therefore is a more accurate and predictable metric to use in a ratio.

This ratio is a great measure for a business that is not profitable but does have positive cash flow, however, this ratio can be more difficult to calculate because it depends on forecasted cash flow which some companies or investors may not have easily available to them.

The formula for the price-to-cash flow ratio is:

EV-to-EBITDA Ratio

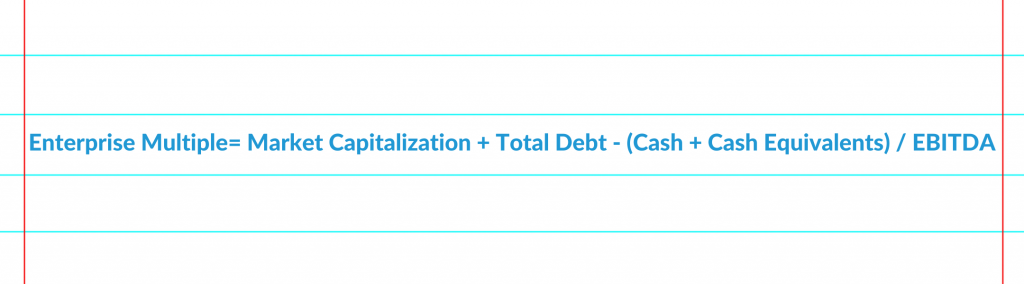

The EV-to-EBITDA ratio determines the relationship between the enterprise value to earnings before interest, taxes, depreciation, and amortization (or EBITDA) of a company and essentially explains how many multiples of EBITDA an investor would have to pay to acquire the business.

This is a great stand-in ratio for the price-to-cash flow ratio as EBITDA can be more easily acquired than cash flow forecasts for a company and is considered a good proxy as such. This ratio also takes into account company debt and profitability which some of our earlier ratios have not.

The EV-to-EBITDA formula is:

Price-to-Sales Ratio

The price-to-sales ratio or P/S is calculated as the stock price divided by sales per share and is a great determinant of value for young companies who often fit the criteria of not having positive net income just yet.

Though this method does not take profitability into account, it is based on the book value of a company which is quantified through common accounting practices, therefore not easily manipulated, and is based on revenue which is seen as a stable financial indicator.

The formula for the price-to-sales ratio is as follows:

Price-to-Book Ratio

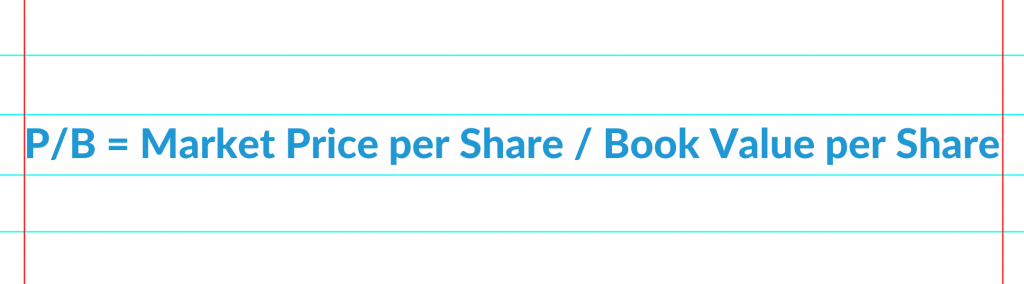

The last ratio we’d like to present is the price-to-book or P/B ratio which compares price to book value per share. Book value is highly tied to the balance sheet of a company as it is the value of a company’s assets minus its liabilities

A good formula to calculate the price-to-book ratio is:

Which Ratio is the Best?

We mentioned this before, but it is worth reiterating that valuation methods and valuation ratios are tightly tied to the purpose for their use as well as the size and financial status of a company (stay tuned for a follow-up blog on valuation methods for younger, less-established companies).

For example, when looking to sell your business, the income approach, or the discounted cash flow method are great options to determine a potential sale value. Similarly, the EV-to-EBITDA ratio would show to the acquirer of a business what their purchasing power is in terms of EBITDA (a stand-in for cash flow).

At this point, you may already have a headache trying to work out which method and which ratio will serve you well. And that’s okay because valuing a business is best left to professionals who have the right expertise to translate the unique context of your company into a customized business valuation. Our team of financial analysts are prepared to help you navigate this topic so you can feel confident in your business valuation. To learn more about how we can help you value your business, reach out to our team and we’ll take it from there.